Automobile Electronics Manufacturing

Business for Sale Industry Economics

$19,146,000,000

Revenue

-3.29%

Projected CAGR

2005 - 2020

Historical

2020 - 2026

Projection

-2.74%

CAGR

$862,000,000

Profit

Quick Scroll

Summary

Over the five years leading up to 2020, the Automobile Electronics Manufacturing market has seen a lot of uncertainty.

As US automakers increased production volumes, industry sales increased at the start of the decade.

The growing technological content available in new vehicles has also helped automotive electronics manufacturers.

Automakers, for example, have mounted advanced sensors and electronic control systems in their cars in order to emphasize superior protection.

Sensors, cameras, and other safety and comfort features are becoming more common in modern vehicles.

The increasing ubiquity of global positioning systems (GPS) is also good news for this industry; most automakers now offer GPS as an optional feature.

Furthermore, the industry has benefited from advances in vehicle technology that have expanded the use of electrical components.

Consumers have also started to expect more modern electronics in new cars.

Performance

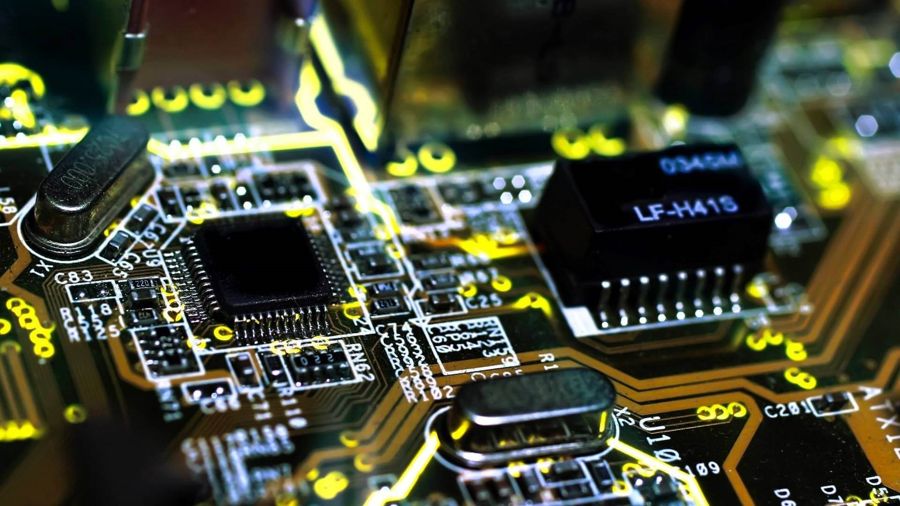

Automobile Electronics Manufacturing produces parts for automobiles that include or work with the help of small components that regulate and steer electric current.

Lighting devices, electrical wiring, electrical control units, alarms, automatic ignition systems, and driver displays are also examples of industry operators.

The sector has been in recession in recent years, with sales dropping by 6.7 percent annually to $19.1 billion in the five years leading up to 2020.

Increased unemployment and waning consumer sentiment harmed sales over this time frame.

However, relatively low interest rates have made big-ticket luxury investments like cars and trucks cheaper to finance.

Additionally, the increasing number of mobile devices inside cars has helped operators reduce sales declines.

Because of the COVID-19 (coronavirus) pandemic, which has resulted in massive drops in new car purchases and the partial closing of industry plants, industry income is projected to drop by 24.5 percent in 2020.

Outlook

In the five years leading up to 2025, the Automobile Electronics Manufacturing market is expected to recover.

Several trends are expected to have an effect on the car manufacturing industry as a whole, facilitating increased sales.

The unemployment rate is predicted to drop after rising rapidly due to the COVID-19 (coronavirus) pandemic, resulting in an increase in the Consumer Confidence Index when combined with a return to economic growth.

When consumers are employed and the economy is looking up, they are much more likely to purchase a car with significant automotive electronics.

Additionally, as cars are produced with more mechanical components, the industry will most likely benefit from an uptick in new car sales.

As a result, industry sales is expected to grow at a 4.1 percent annualized rate to $23.4 billion in the five years leading up to 2025.

Industry

This industry creates parts for automobiles that include or work with the help of small components that regulate and guide electric current.

Lighting devices, electrical wiring, electrical control units, alarms, automatic ignition systems, and driver displays are also examples of industry operators.

Electric motor manufacturers are not included.

Investment

Sector operators demand complex machinery, specialized workers, and typically specialized research personnel, by which the Automobile Electronics Manufacturing industry has a moderate level of capital intensity.

The average industrial operator will spend $0.14 on capital for every dollar spent on labor. The capital requirements of the sector have increased as the automation of routine industrial operations has increased. Plastic injection molding, for example, is used to make casings and other plastic components.

This is a very automated operation. By outsourcing the actual production of electrical and plastic components to semiconductor manufacturers, automotive electronics manufacturers keep their capital intensity low.

Electronic circuit boards are manufactured in clean room facilities for many of the industry’s products; the multi-step manufacturing process is frequently outsourced to specialist fabrication businesses, with circuit designs acquired or created in-house.

In general, the capital needs of this business reflect the capital costs of automotive electronics research and assembly, but not always the full manufacturing chain.

Volatility

Over the five years leading up to 2020, the Automobile Electronics Manufacturing industry has had moderate to high revenue volatility. The manufacturing of automotive electronics has always been a risky business.

Automobiles and trucks are long-lasting items that are acquired at a high cost and then used over a lengthy period of time. Because of its high cost, people and companies will often put off purchasing a car during a downturn, preferring to wait until their immediate financial situation improves.

As a result, the motor vehicle manufacturing sector’s income varies substantially depending on the status of the general economy, because car electronics are mostly employed in the production of new automobiles, the Automotive Electronics Manufacturing industry’s income fluctuates with changes in automobile sales, which can vary dramatically from year to year.

For example, due to the coronavirus pandemic, income has risen as much as 6.8% in 2017 and fallen as much as 24.5 percent in 2020 during a five-year period. Despite this, the Car Electronics industry’s revenue volatility is moderated by income from sales for use in automobile repair and maintenance services.

While aftermarket components sales are substantially lower than sales to manufacturers, auto repair services are less impacted by macroeconomic trends than motor vehicle manufacturers since the cost of fixing one’s vehicle is far lower than the cost of acquiring a new car.

This means that even during a downturn in the economy, companies and customers continue to get their cars fixed. As a result, while revenue volatility in the Automobile Electronics Manufacturing business is moderate, it is lower than in the motor vehicle manufacturing business.